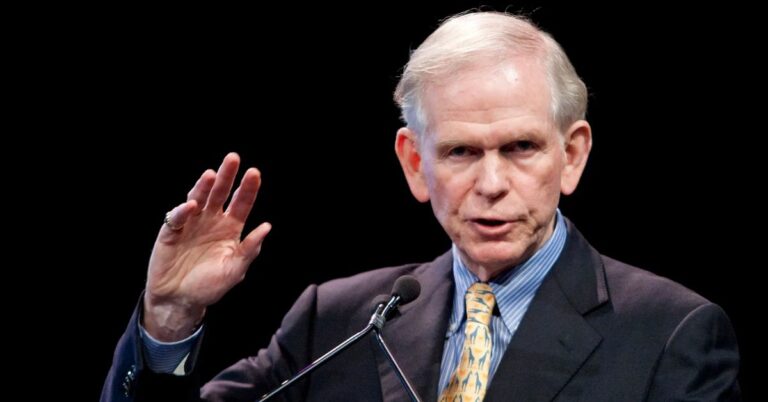

Jeremy Grantham, co-founder of Grantham, Mayo, Van Otterloo & Co. (GMO), is a name synonymous with value investing and market analysis. With decades of experience in finance, Grantham has garnered a reputation for his insightful commentary on market trends, investment strategies, and economic predictions. His unique perspective, especially on market bubbles and sustainability, has made him a trusted voice for both seasoned investors and novices alike. In this article, we delve into the key lessons that investors can learn from Grantham’s wisdom.

Understanding Market Cycles

One of the fundamental teachings from Jeremy Grantham is the importance of recognizing market cycles. Grantham posits that financial markets are not only driven by economic fundamentals but also by psychological factors and collective investor behavior. He often emphasizes that markets move in cycles of expansion and contraction, influenced by periods of optimism and pessimism.

Grantham’s analysis encourages investors to adopt a long-term perspective. During times of market exuberance, he warns of the potential for overvaluation, leading to inevitable corrections. Conversely, in bearish markets, he highlights the opportunities presented by undervalued assets. By understanding these cycles, investors can position themselves strategically, buying when others are fearful and selling when there is widespread euphoria.

The Dangers of Overvaluation

Another key lesson from Grantham is the peril of investing in overvalued markets. He has repeatedly warned that market bubbles—periods where asset prices soar well above their intrinsic values—are not only unsustainable but often lead to significant downturns. Grantham’s firm employs rigorous valuation metrics to assess the relative worth of various asset classes.

For instance, Grantham has pointed to historical price-to-earnings (P/E) ratios as a reliable indicator of market valuation. He notes that when P/E ratios significantly exceed historical averages, the likelihood of a market correction increases. This insight serves as a valuable reminder for investors to maintain discipline and to question prevailing market sentiment.

The Importance of Diversification

Grantham advocates for diversification as a cornerstone of a sound investment strategy. He believes that spreading investments across different asset classes, sectors, and geographical regions can mitigate risk and enhance returns. This approach helps to cushion against the volatility inherent in any single investment.

In Grantham’s view, a well-diversified portfolio not only includes stocks and bonds but also alternative assets such as real estate, commodities, and even art. He argues that diversification helps to smooth out returns over time and can be particularly beneficial during periods of economic uncertainty. This lesson is particularly relevant today, as global markets face unprecedented challenges, from geopolitical tensions to climate change.

The Shift Towards Sustainable Investing

In recent years, Jeremy Grantham has become a vocal proponent of sustainable investing. He argues that environmental, social, and governance (ESG) factors are not just ethical considerations but essential components of sound financial analysis. Grantham warns that climate change poses significant risks to global economies and that investors need to adapt their strategies accordingly.

Grantham’s insights suggest that companies demonstrating strong ESG practices are likely to outperform their peers in the long run. This perspective encourages investors to look beyond traditional financial metrics and to consider the broader impact of their investments. By aligning financial goals with sustainable practices, investors can contribute to a healthier planet while also achieving robust returns.

Behavioral Finance: The Psychology of Investing

Understanding the psychological aspects of investing is another vital lesson from Grantham. He highlights that emotions—fear and greed—play a crucial role in market movements. Grantham believes that many investors fall victim to herd behavior, leading to irrational decision-making.

By recognizing these psychological traps, investors can develop a more disciplined approach. Grantham advocates for strategies such as dollar-cost averaging, which allows investors to build positions over time regardless of market conditions. This method reduces the emotional burden of trying to time the market and can lead to more consistent long-term results.

The Value of Patience and Discipline

Patience and discipline are hallmarks of Grantham’s investment philosophy. He often reminds investors that successful investing is a marathon, not a sprint. Short-term market fluctuations can be misleading, and reacting impulsively can lead to poor decisions.

Grantham encourages investors to stick to their long-term strategies, even in the face of market volatility. This requires a commitment to research and a solid understanding of one’s investment thesis. By remaining patient and disciplined, investors are more likely to achieve their financial objectives and weather the inevitable ups and downs of the market.

Learning from History

Grantham frequently emphasizes the value of historical analysis in investing. He believes that understanding past market trends and economic cycles can provide valuable insights for future investment decisions. By studying historical market behavior, investors can identify patterns that may repeat over time.

Grantham’s approach includes looking at various data points, including economic indicators, valuation metrics, and geopolitical events. He urges investors to learn from both the successes and failures of previous market cycles. This historical perspective not only informs investment decisions but also helps to build a more resilient investment strategy.

Embracing Innovation and Change

Another critical lesson from Jeremy Grantham is the importance of embracing innovation and change. In a rapidly evolving global economy, adaptability is key. Grantham notes that technological advancements can disrupt entire industries and create new investment opportunities.

Investors need to stay informed about emerging trends, such as renewable energy, biotechnology, and digital finance. Grantham encourages investors to be open-minded and to consider how these innovations might reshape traditional sectors. By being proactive in identifying and investing in transformative technologies, investors can position themselves for long-term growth.

Conclusion

Jeremy Grantham’s insights provide a wealth of knowledge for investors at all levels. His emphasis on understanding market cycles, recognizing the dangers of overvaluation, and the importance of diversification are fundamental principles that can enhance any investment strategy. Furthermore, his advocacy for sustainable investing and awareness of behavioral finance are increasingly relevant in today’s complex financial landscape.

By adopting Grantham’s lessons and applying them to their own investment approaches, investors can cultivate a more disciplined, informed, and resilient mindset. As the financial world continues to evolve, Grantham’s wisdom will undoubtedly remain a valuable guide for those seeking to navigate the intricacies of investing successfully.